Office Based Headsets - A Key Element of the Home Working Revolution

The rate of growth in the office based headset market has been steadily increasing in recent years. A key driver of this has been the rising importance of video conferencing, explored in Futuresource’s 2020 Video Conferencing report.

Many end users have been looking to improve their video conferencing experience, leading to investment in more sophisticated audio and video technologies, with headsets being a key beneficiary of this. The steady market growth that has been observed in recent years was expected to continue into 2020, but no-one could have predicted how explosive a year this would be for video conferencing and associated technologies.

In order for businesses to continue operating during the pandemic, the ability to work from home has become essential where it has been possible. The home working revolution has meant that businesses have needed to equip all employees with the ability to communicate remotely, with this wave of purchases boosting demand to unforeseen levels. This has also had significant impacts on technology and pricing trends.

The call centre vertical was historically somewhat of an outlier when compared to the rest of the market. Broad telephony infrastructure and the unsuitability to such environments of Bluetooth, due to the dense radio frequency environments that would result, led to call centres adopting RJ9 and DECT wireless headsets. With call centre operators mostly now working from home, radio frequencies are not a problem, and office telephony is not available. This has led to these already diminishing connectivity types being hit hard in favor of USB connected headsets as the affordable and available option.

Working from home also means that consumer behavior is a far greater decider on which headsets people prefer to use. Headsets that are marketed as being equally capable at making high quality calls, as well as listening to music and other media are on the rise. At the same time, the increasing availability and economies of scale created by the consumer market in technologies such as active noise cancellation, true wireless, and capable in-built microphones, will lead to these technologies becoming much more relevant in the office headset market in the years to come.

While the pandemic has provided a huge opportunity for the office headset market, the demand generated by the boom in home working in 2020 has led to significant supply shortages. Some end users have been prepared to wait for their orders to be fulfilled, but most businesses looking to equip end users with headsets at home have had to make do with whatever products are available: anything to allow them to continue business “as normal.”

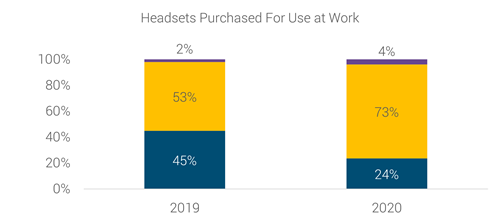

This has resulted in increased sales of all headset types. Within the office headset market, low-end, more affordable products enjoyed the greatest success as product quality was considered secondary by many to availability. The greatest increase came outside the traditional office headset market, however. Sales of consumer and gaming headsets for use, at least partially, for work are soaring in 2020 and it is expected that only a quarter of headsets purchased for use at work will be true office headsets by the end of 2020.

The ‘partial’ use for work element of this is extremely significant and something that is going to dominate future discussions about use of office headsets in the home office. In 2020, the keyword has been availability, but in the future the choice between consumer and office headsets will come down to who is buying, selecting, and funding the purchase of a headset.

For example, where end users themselves are purchasing headsets, they are more likely to choose a product that they can use both for work and for leisure. However, where a business is equipping its workforce to allow them to work from home, they are far more likely to purchase a dedicated office headset.

In 2020, the consumer market had a much greater availability of product than the office headset market and so the market has shifted in that direction. Moving into 2021-22, end users and businesses will be looking to upgrade their make-shift headsets into dedicated office solutions or to upgrade from lower-end office products to more advanced, higher-end headsets.

Like all product areas involved in the nebulous “collaboration” industry, the office headset market has been transformed by the tragic nature of 2020. A steadily growing market has been faced with demand far exceeding what anyone could have foreseen, much of which is currently being fulfilled by alternative devices. As long as working from home, or at least hybrid working, is the “new normal,” the opportunity for office headsets will continue to grow, particularly as end users realise the shortcomings of consumer devices in a work setting.

More information on the above can be found in Futuresource’s Video Conferencing and Office Headset Market reports. In addition, our virtual Audio Collaborative event this November will be covering a range of exciting panel sessions discussing the future of audio, with topics including the battle for ‘Share of Ear’ and growth of hearables. Find out more and save your seat today.

Latest Enterprise and Professional AV Insights